[ad_1]

Etherem’s transfer to proof of stake can also be referred to as Ethereum 2.0 or “The Merge”. On this information we’ll overview what the transition is, why it’s taking place, the advantages Ethereum 2.0 will deliver, demystify some widespread misconceptions and clear up the influence it’s going to have on the world of crypto.

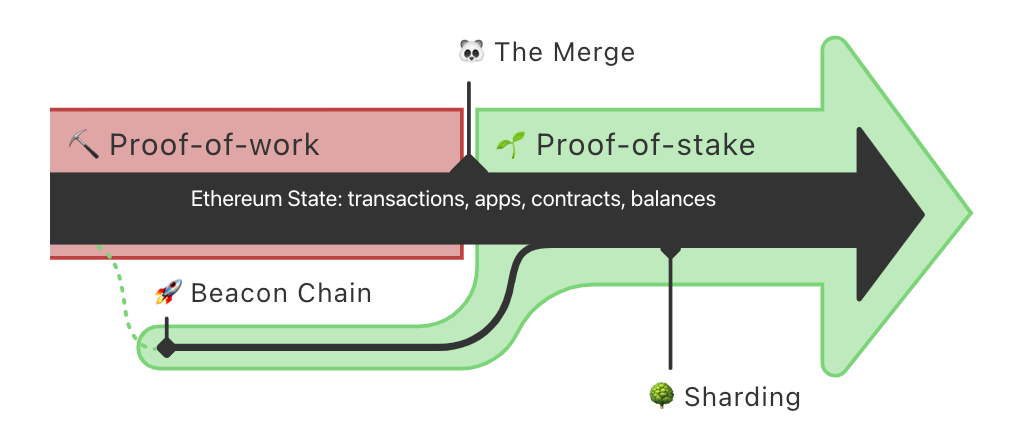

Ethereum will transfer to a proof of stake consensus when it merges with the Beacon Chain (aka the Consensus Layer)

ETH2 just isn’t a brand new asset. The ETH in your pockets or change account won’t be impacted.

Ethereum’s transition to proof of stake will deliver quite a few advantages, together with improved effectivity, scalability, and safety, in addition to lowered centralization

What’s Ethereum 2.0?

Ethereum 2.0 just isn’t a brand new asset, however is the identify given to a set of updates coming to the Ethereum Community. The preliminary updates will see Ethereum merging with the Beacon Chain and transitioning from a proof of labor (PoW) consensus to proof of stake (PoS). Over the following few years, extra updates equivalent to sharding will roll out.

What precisely is being merged?

The community that everyone knows as Ethereum (ETH1/Execution Layer) shall be merging with the Beacon Chain (ETH 2/Consensus Layer). The Beacon Chain is a separate community working parallel to Ethereum. At present, Ethereum makes use of a proof of labor mannequin to validate blocks. On this mannequin, validators compete in an effort to acquire the rights to provide the following block. After The Merge, Ethereum’s blocks shall be produced solely via the Beacon Chain leveraging a proof of stake mannequin. Ethereum’s proof of labor mannequin shall be shelved completely. The Beacon Chain shall be actively coordinating all of the block validating exercise, randomly choosing validators for participation.

Fast explainer on proof of stake (PoS) vs proof of labor (PoW)

“Proof of stake” and “proof of labor” are the most well-liked consensus mechanisms utilized in cryptocurrency to validate and add transactions to the blockchain. Proof of labor, popularized by Bitcoin, includes validators utilizing excessive quantities of processing energy to resolve math issues and compete for the proper to validate and create blocks. PoW validators are rewarded for every new block created. As compared, proof of stake is a consensus mechanism the place members in a community should stake a number of the underlying asset so as to have the ability to take part in securing the community.

What’s Ethereum 2.0’s launch date? When will Ethereum change to proof of stake?

The Ethereum improvement group is making good progress and we count on ETH 2 to go reside in 2022. As of July 2022, the Ethereum core builders up to date the Ethereum merge timeline with a tentative launch date someday throughout the week of September nineteenth, 2022. There have been three testnets that have been scheduled to be merged over the past couple of months and two of them have been efficiently merged already. The ultimate testnet is scheduled to be merged round August eleventh. After that, the one factor left shall be merging Ethereum mainnet. We’re very, very shut.

Right here’s how Ethereum’s transition to proof of stake will work

Each twelve seconds, the Beacon Chain will randomly choose a gaggle of validators (stakers) and designate roles. The dimensions of the group is 1/thirty second of all stakers on the community (at present, this could imply a gaggle of over 12,000). One of many chosen validators would be the block proposer. The opposite chosen validators are referred to as attesters, as they are going to attest to the blocks validity as soon as it has been proposed by the block proposer. A brand new block proposer shall be appointed each time a brand new block is created. A number of folks in every group can have the chance to suggest a block. If a block proposer misbehaves in any manner then they must pay a penalty. This is called “slashing”.

Stakers obtain rewards for collaborating however they’re additionally prone to dropping some or all of their stake in the event that they do one thing malicious equivalent to proposing or testifying a number of blocks for a similar place within the chain. That is the best way the protocol protects itself from a hostile takeover.

Individuals who stake their ETH to supply safety to the community obtain all of the block rewards and transaction charges generated by the community (excluding all charges burned by the community on account of EIP-1559). It’s shared equally among the many pool of stakers – it doesn’t matter in case you have been in a selected group of members, you continue to get rewards.

Why is Ethereum transferring to proof of stake?

Ethereum’s transition to proof of stake will deliver quite a few advantages, together with improved effectivity, scalability, and safety, in addition to lowered centralization.

Higher vitality effectivity

Ethereum will see a 99.95% discount in energy used to safe the community.

Much less reliance on specialised {hardware}

In Ethereum’s present proof of labor scheme there’s heavy reliance on excessive output graphics playing cards. Not solely are these costly to switch but additionally reliance on these creates unseen dependencies on provide chain dynamics. Contrastingly, after The Merge a typical laptop computer can be utilized to take part in securing the community so {hardware} necessities are a lot simpler to acquire.

Lowered centralization threat

With out the necessity for specialised {hardware}, anybody can turn into a staker. The extra folks that take part in safety, the extra sturdy a series turns into. With much less energy getting used and simpler {hardware} necessities, economies of scale are a smaller issue. In proof of labor, miners might be pinpointed on a map based mostly on excessive vitality utilization. With the vitality discount in proof of stake, nodes which might be collaborating might be focused much less simply.

Considerably much less ETH issuance

With considerably much less vitality and cheaper {hardware}, stakers won’t require as a lot ETH to be incentivized to take part in securing the community. ETH issuance will drop from 4.3% to 0.43%. That’s a 90% discount! This can be a large shift within the fundamentals of Ethereum the asset. This mixed with the ETH being burned since EIP-1559 could make the Ethereum asset deflationary.

Extra sturdy in opposition to assaults

Financial penalties for misbehavior within the type of “slashing” make it exponentially extra pricey for dangerous actors to aim assaults as in comparison with proof of labor. Attackers can truly be faraway from the pool of stakers and solely be reinstated after a number of weeks. That is along with the financial penalties for submitting dangerous blocks and different types of misbehavior.

Unlocks new scalability prospects

In proof of stake all of the nodes are taking part in a coordination recreation as an alternative of a aggressive one. This unlocks new methods to scale with the constructing blocks in place for sharding. With the Beacon Chain coordinating between all of the validators, it’s a small adjustment to begin coordinating consensus on a number of shards of the community.

Widespread misconceptions about Ethereum 2.0/The Merge

How will ETH 2 present up in my pockets?

Although “ETH 2” is a time period thrown round lots, there’s truly no new ETH asset related to The Merge. Your present ETH will work simply because it all the time has and be unaffected. Due to this false impression, ETH 2 is usually referred to as “the consensus layer”.

After The Merge, will ETH fuel charges be cheaper?

The quick reply is not any, however it might result in decreased fuel charges sooner or later. Fuel charges are associated to dam area demand. The merge does nothing to extend block dimension nor does it lower demand for block area which might be counterproductive to the well being of the community.

The merge does set the stage for sharding, which can enhance block area and thereby lower fuel charges. The explanation for this false impression is that at one level “The Merge” was going to incorporate sharding however this has been separated into its personal improve.

Fuel charges are ruled by easy provide and demand. If there’s extra demand than provide then fuel costs are excessive. If there’s extra provide than demand then fuel costs shall be low. Sharding will enhance the quantity of obtainable block area much like how layer 2 options are growing the obtainable block area by rolling up transactions. So decreased fuel charges are on the horizon however perhaps nonetheless a pair years down the highway.

After The Merge, I’ll be capable to withdraw my staked ETH.

Staked ETH withdrawal won’t be enabled till after the following Ethereum improve (Shanghai) which is scheduled 6-12 months after The Merge.

How will The Merge have an effect on customers?

On a regular basis customers and BitPay prospects won’t be impacted. BitPay will proceed to course of Ethereum-based funds for retailers. The BitPay Pockets will help ETH 2.0 as an asset that you would be able to purchase, retailer, swap and spend. Moreover, BitPay Card customers will be capable to convert Ethereum to money uninterrupted.

FAQs about Ethereum 2.0

What’s “Ethereum Sharding”?

Sharding is a multi-phase improve to enhance Ethereum’s scalability and capability. It’s going to allow cheaper transactions whereas sustaining Ethereum’s safety. It’s set to observe The Merge as Ethereum’s subsequent improve.

How a lot ETH do I have to take part in ETH 2.0? How can I stake Ether with ETH 2?

Capital necessities to take part are fairly steep at 32 ETH. Nonetheless, there are a number of initiatives equivalent to Rocket Pool and the Obol Community which might be creating options for customers with fewer ETH to have the ability to take part.

Is ETH 2 a brand new coin? How do I purchase ETH 2?

You do not want to purchase one other ETH asset in an effort to take part in Ethereum 2. ETH 2 just isn’t a brand new standalone asset. The Ether you at present have will nonetheless perform on the Ethereum Community following The Merge.

What’s going to occur to Ethereum when 2.0 comes out?

Ethereum’s present proof of labor consensus shall be shelved. Nonetheless, the community will nonetheless function the identical to its finish customers.

[ad_2]

Source link